The Average Cost Of A Roof Project

Depending on the type of roofing project, the typical expense to hire a roofing contractor varies significantly. In 2023, most homeowners pay between $379 and $1,755 for a roof repair. Thus, the average cost to repair a roof is approximately $1,067. However, the expense to replace an asphalt shingle roof in 2023 ranges from $8,500 to $14,300, with the average price being around $10,000. Most homeowners don’t have this amount of available funds and need financing.

Factors Impacting The Price Of A New Roof

How much a roof costs to replace depends mainly on several critical elements:

Geographical Location

Where you reside plays a meaningful role in the price of labor and materials. Remote locations tend to observe higher overhead costs. Densely populated coastal areas also experience a similar trend.

Roof Layout

A roof’s complexity significantly impacts its overall cost. Generally, the material and labor expenses may increase substantially if a rooftop has several different pitches/slopes, shapes, and angles.

Roof Size

The square footage of the roofing surface plays an essential role in determining the overall material cost for a new roof. Naturally, the more square footage, the greater the expense for roofing materials.

Roofing Contractor Selected

Roofers utilize various labor pricing practices depending on factors such as knowledge, experience, geographical location, and company size. Compare contractor rates by securing estimates.

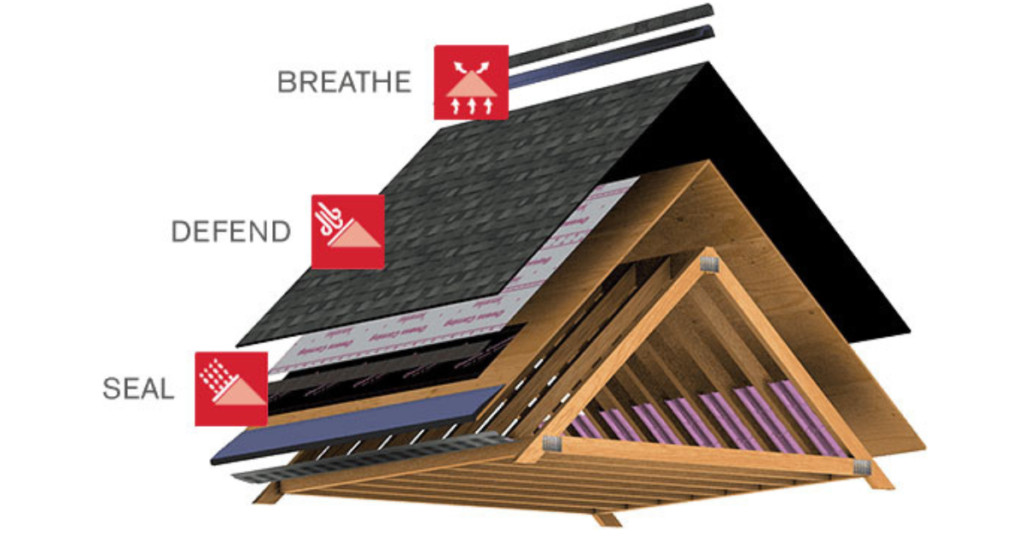

Type Of Roofing Material

An asphalt shingle roof tends to be more affordable than a steel, wood, slate, metal, or tile roof. But other roofing materials (e.g., decking, underlayment, flashing, venting) have varied price points.

Benefits Of Financing A Roofing Project

Deferred Upfront Payment

Most lending options provide a meaningful way to delay repayment by the borrower. That way, the homeowner, as the borrower, can proceed with the roofing project without waiting an extended period.

Low Monthly Payments

For most homeowners, a periodic payment plan eases the challenge of repayment. Most lending alternatives offer a predictable installment schedule that permits a homeowner to budget payments affordably.

“Quick” Access To Funds

Often, a roofing project cannot wait, especially if the roof has fallen into substantial disrepair. Viable lending options permit homeowners to proceed with essential roof repair or replacement work.

Options For Financing A Roof Project

Cash-Out Refinance

For this alternative, the homeowner first pays off their current mortgage, securing a new one at a higher loan amount. The borrower then applies the difference in the two loan amounts to the roofing project. The interest rates for this option are lower than home equity loan rates. In addition, FHA cash-out refinance lenders allow more borrowers to qualify for financing than other forms of funding.

Credit Card

For almost instant access to funds, a credit card (or series of credit cards) allows the homeowner to proceed with a much-needed roofing project. If a homeowner possesses a relatively good credit rating, qualifying for a new credit card with a 0% or low introductory APR provides an interest-free borrowing option for a short time (generally 12 or 18 months). However, interest rates will jump afterward.

Home Equity Line Of Credit (HELOC)

Akin to a credit card, a HELOC provides a credit line secured by a borrower’s home. The homeowner converts their home equity to cash on an as-needed basis. Interest rates are commonly lower than personal loans or credit cards. Better loan terms and interest rates could be available if the borrower banks with the institution offering the HELOC. Homeowners make repayment only on the balance owed.

Home Equity Loan

This borrowing alternative permits a homeowner to secure a lump sum distribution using the equity built into their home as collateral. For homeowners with a strong credit rating and steady income source, this loan provides relatively quick access to substantial funds. The primary drawback is interest rates on borrowing funds through this option can adjust meaningfully and unpredictably over time.

Personal Loan

Depending on your credit score and the loan term, a personal loan allows a borrower to access a lump sum quickly. Repayment terms typically are fixed-rate monthly installments. The homeowner does not need to use their home as collateral or have a lien placed on their home. However, APRs range significantly from relatively affordable (around 5%) to practically cost-prohibitive (approaching 40%).

Renovation Loan

Calculating the estimated value of the borrower’s home following an upgrade in the materials or aesthetics of their roof, this financing option (also known as a fixer-upper loan) delivers substantial borrowing power to the homeowner compared with other alternatives. Both FHA and Fannie Mae afford qualified homeowners reasonable access to this attractive and cost-effective financing solution.

Roof Contractor Financing With Yellowhammer Roofing

Select roofing companies, including Yellowhammer Roofing in Birmingham, AL, offer homeowners a tremendous opportunity to secure affordable financing directly from the contractor. We provide flexible financing options to enable homeowners to repair or replace their roofs now and make payments over time. If you own a home in Tennessee or Alabama, contact us today to schedule an appointment to learn more.